Getting My Donate A Car To Charity Riverside Ca To Work

Table of ContentsThe Main Principles Of Donate A Car To Charity Aurora Co Getting My Donate A Car To Charity Bakersfield Ca To WorkFascination About Donate A Car To Charity Wichita Ks3 Simple Techniques For Donate A Car To Charity Lexington KyThe Of Donate A Car To Charity Lexington Ky

From getting a scrap vehicle out of your driveway to considerable tax obligation benefits, contributing an automobile provides a whole lot of advantages (Donate A Car To Charity Aurora CO). We'll cover the most crucial. Donating a vehicle to charity can offer a variety of benefits: You'll obtain rid of an automobile jumbling up your driveway, You'll help a charity by giving a lorry they can offer, If you comply with the policies correctly, you'll shave several of your tax responsibility, It's all fairly simple and uncomplicated, but you do intend to understand the ins and also outs of car contribution to ensure that you're receiving the maximum tax obligation benefit, as well as donating to charities that are able to extract the maximum worth from your donation without covert costs.Donating a car is as easy as clicking a website or grabbing the phone. It actually could not be less complex. Donate A Car To Charity Honolulu HI. Once you call a charity, they'll make arrangements to either have you drive the lorry to a central place, or they'll pay a wrecker ahead and select it up from you.

5 million non-profit philanthropic companies in the United States. There are a whole lot of organizations that millions of us have certainly heard of, however that aren't precisely doing the ideal for the charities that they're intended to be helping.For example,you 'd want to understand just how much of the cash created from auto contributions was invested on overhead costs like rental fee, exec wages as well as advertising.

The 7-Minute Rule for Donate A Car To Charity Cleveland Oh

7 million on advertising and marketing and promo, even more than the quantity of the give itself. Fortunately, there's a company known as Charity, See that assists to weed out the negative stars and provide strong info on better companies.

And yes, there are expenses that are connected with accepting lorry donations. The Automobile Talk Lorry Contribution Program pays for lugging, title transfer, auction or taking down fees, and also other expenses associated with the program. Yet, the program is able to return a minimum of 70% of published here the gross profits to the NPR stations it sustains, well over Charity, Watch's 60% threshold.

In order to acquire the most substantial tax benefit you ought to: Detail your tax return: This is essential if a tax obligation advantage is just one of your reasons for contributing. You must itemize your deductions to obtain any type of tax benefit. Recognizing your Tax Bracket: The allowable tax advantage is based upon which tax obligation brace you fall into.

More About Donate A Car To Charity Wichita Ks

Before you contribute your cars and truck, you'll desire the title. Normally, it calls for filing for a lost title with your state's Division of Motor Cars, yet if your lorry is older than 25 years old in numerous states, a title isn't needed.

They do not have to be currently running. Your vehicle donation will certainly be marketed at an auction or to recover depending on condition. If you doubt regarding whether or not your car is eligible, please speak to the car donation program toll totally free at 1-866-628-2277. We make donating your vehicle as simple and hassle-free as possible.

Call our reps at 1-866-628-2277. No. Unique arrangements can be made by calling our rep - Donate A Car To Charity St. Paul MN. The only documents required is a signed, clear title. Have your title with you when you call-in your contribution or enter it online. [Please note: a clear title shows the title remains in the name of the donor without a lien]

Yes, our chauffeur will certainly provide a tow receipt at the time of pick-up. This is not your last tax receipt unless the sale of your lorry does not surpass $500. This first acknowledgement will certainly show your name in addition to the year, make, version and problem of the vehicle you are donating.

Some Known Questions About Donate A Car To Charity Corpus Christi Tx.

We recommend you consult your tax consultant with concerns regarding your reduction. Donate A Car To Charity Fort Wayne IN.

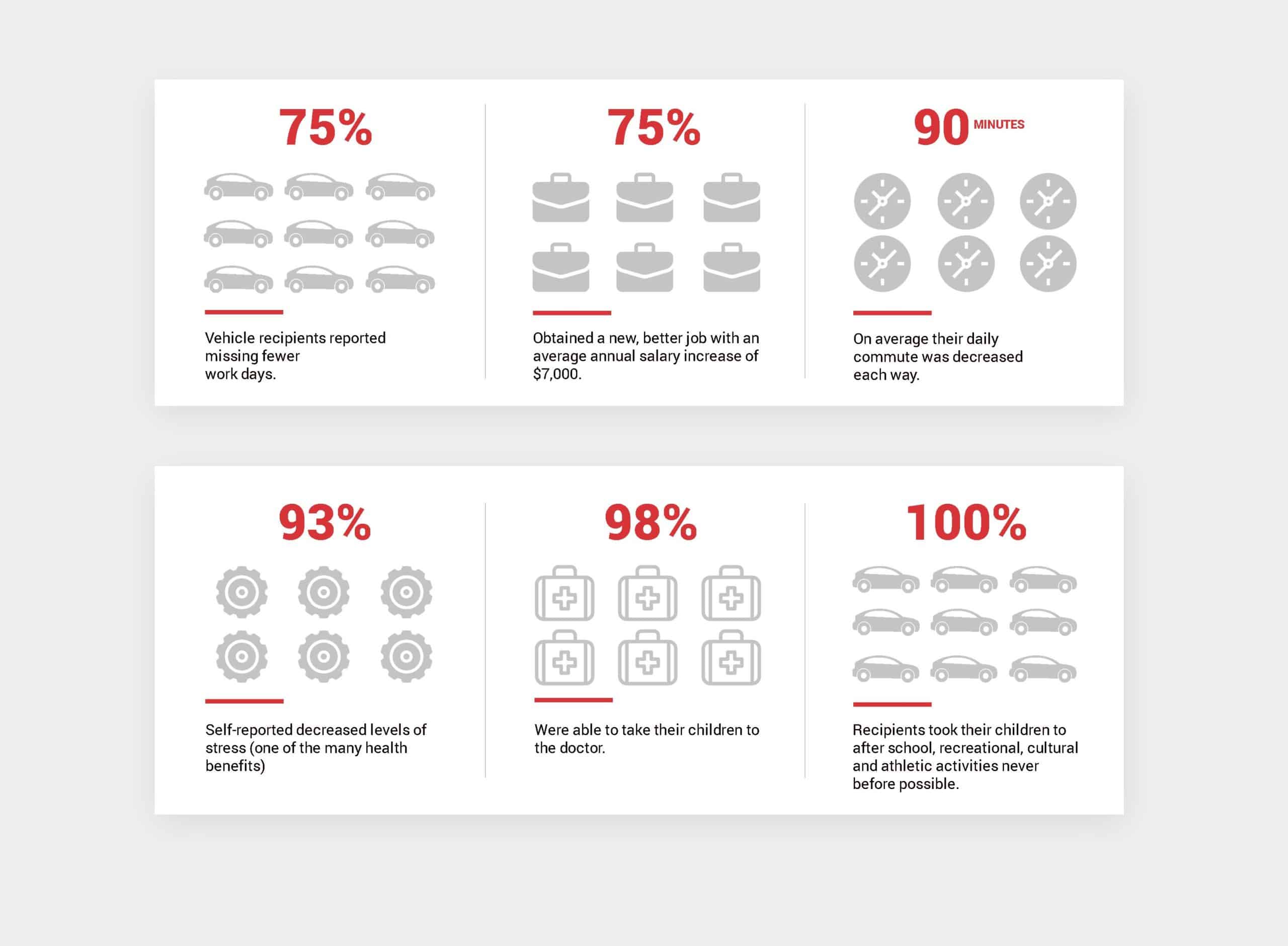

We exceed the 75% of revenues that watchdog companies say a charity should certainly spend on their services. When you donate your car, you help us go above and beyond! Obtained a reason you appreciate? There's no much better way to help than by making a donation! And with the cars and truck gone that's one much less thing to stress over.

All those minutes add up to very useful help! Writing your donation off might be a little challenging however that's just since there's so numerous different ways your contribution can be beneficial! The good news is, in all circumstances, you'll get a tax obligation write-off. A great deal of charities that take autos supply the alternative to get the vehicles themselves, however if towing as well as getting the automobiles set you back money after that they may deduct that from the automobile's worth, which makes your tax obligation deduction smaller.

Not known Facts About Donate A Car To Charity Santa Ana Ca

The American Jobs Production Act of 2004 restricted the amount one might take as a reduction for an electric motor automobile that was donated with a fair-market value that goes beyond $500. It's now additionally needed to record the method which we utilize the car and in a lot of cases an independent, specialist appraisal is necessary.